#AskMelanie: What is the best way to transfer ownership of a family cottage?

This month we tackle a question that I often see families trying to figure out. What is the best way to transfer ownership of a family cottage? Here is some advice I found useful on Canadian Capitalist:

Canadians love their cottages. They are willing to put up with three hour drives, traffic jams, never ending repairs and maintenance and constant hosting duties for their piece of tranquility by the lake. However, I would suggest the family cottage is one of the most problematic assets for income tax planning purposes, let alone the inherent family politics that are sure to arise.

For purposes of this blog, I will just assume away the family politics issue. I will assume the children will each grab a beer, sit down at a table and work out a cottage sharing schedule to everyone’s satisfaction and while they are at it, agree on how they will share the future ownership of the cottage when their parents transfer the cottage or pass away. I would say a very realistic situation in Canada, not!!!

Let’s also dismiss any illusions some may harbor that they can plan around the taxation issues related to cottages or even avoid them entirely. I can tell you outright, there is no magical solution to solving the income tax issues in regards to a family cottage, just ways to mitigate or defer the issues. Many cottages were purchased years ago and have large unrealized capital gains.

So let’s start by taking a step back in time. Prior to 1981, each spouse could designate their own principal residence (“PR”) which, in most cases, made the income tax implications of disposing or gifting a family cottage a null and void issue. The principal residence exemption (“PRE”) in the Income Tax Act essentially eliminated any capital gain realized when a personal use property was sold or transferred. Families that had a home in the city and a cottage in the country typically did not have to pay tax on any capital gains realized on either property when sold or gifted.

However, for any year after 1981, a family unit (generally considered to be the taxpayer, his or his spouse or common-law partner and unmarried minor children) can only designate one property between them for purposes of the PRE. Although the designation of a property as a PR is a yearly designation, it is only made when there is an actual disposition of a home. For example, if you owned and lived in both a cottage and a house between 2001 and 2011 and sold them both in 2011, you could choose to designate your cottage as your PR for 2001 to 2003 and your house from 2004 to 2011 or any other permutation plus one year (the CRA provides a bonus year because they are just a giving agency :)).

In order to decide which property to designate for which years after 1981, it is always necessary to determine whether there is a larger gain per year on your cottage or your home in the city. Once that determination is made, in most cases it makes sense to designate the property with the larger gain per year as your personal residence for purposes of the PRE.

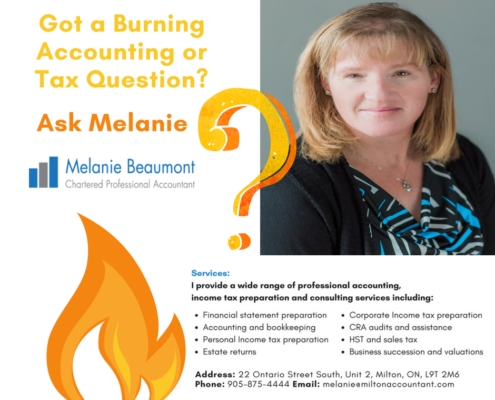

I provide a wide range of professional accounting, income tax preparation and consulting services including:

I provide a wide range of professional accounting, income tax preparation and consulting services including:

• Financial statement preparation

• Accounting and bookkeeping

• Personal Income tax preparation

• Estate returns

• Corporate Income tax preparation

• CRA audits and assistance

• HST and sales tax

• Business succession and valuations

• Business Start-ups

Let’s get started in three easy steps:

- Learn more about me ⇨ Send me a LinkedIn connection invite

- Send me an Email ✉ Send me a message at melanie@miltonaccountant.com

- Call ✆ Give me a call locally at 905-875-4444

Get more advice from Melanie on her blog and connect with her on Facebook and Twitter as well!

Leave a Reply

Want to join the discussion?Feel free to contribute!