#AskMelanie : What Happens if I File My Taxes Late?

In business and life ignorance is never an acceptable excuse! Every week I’m here to let you in on financial implications in order to support your goals and financial well-being. In our new series, “Ask Melanie” find out what happens when you don’t file your taxes.

Melanie, What Happens if I File My Taxes Late?

If you have a balance owing, a penalty is applied immediately based on your balance. The penalty is 5% plus 1% for each complete month your return is late (to a maximum of 12 months). If you are entitled to a refund, no need to worry, right?

Correct for this year, but don’t be late in any of the next 3 years because of your penalty will double!

My advice: Best to play it safe and have your tax return prepared by the April 30th deadline every year. If you made a mistake or run into unforeseen circumstances, not to worry please reach out. I would be happy to discuss your situation confidentially. There is no judgment, just solutions.

Have a tax or bookkeeping question for me? Leave a comment below or email with your question so we can feature your question and my solutions in an upcoming blog.

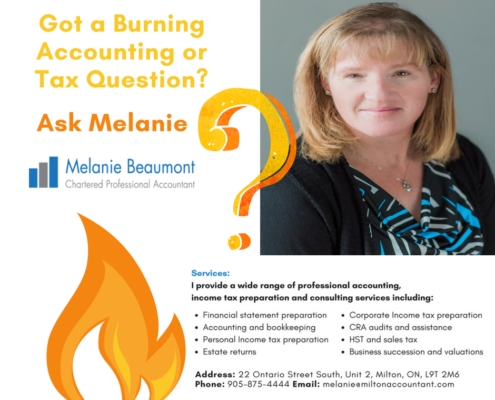

I provide a wide range of professional accounting, income tax preparation and consulting services including:

I provide a wide range of professional accounting, income tax preparation and consulting services including:

• Financial statement preparation

• Accounting and bookkeeping

• Personal Income tax preparation

• Estate returns

• Corporate Income tax preparation

• CRA audits and assistance

• HST and sales tax

• Business succession and valuations

• Business start ups

Let’s get started in three easy steps:

- Learn more about me ⇨ Send me a LinkedIn connection invite

- Send me an Email ✉ Send me a message at melanie@miltonaccountant.com

- Call ✆ Give me a call locally at 905-875-4444

Get more advice from Melanie on her blog and connect with her on Facebook and Twitter as well!

Leave a Reply

Want to join the discussion?Feel free to contribute!