#AskMelanie: What happens to CPP Benefits after the death of a spouse?

Losing your spouse is a life-changing event. Coping with funeral planning and required paperwork can be time-consuming and overwhelming. Finding out what your survivor benefits will often come as a shock. In this recent CBC article, we look at this issue:

Here are some key questions and answers:

What if surviving spouse is under 65?

If the surviving spouse is under age 65, they get 37.5 per cent of the partner’s pension, plus a flat rate that rises every year. This year that rate is $193.66 a month.

What if partner dies before applying for CPP?

The deceased spouse’s CPP benefit is calculated based on what they have contributed so far in their working life, whether they’re 25 or 65. The survivor’s benefit is calculated based on that number — 60 per cent if the survivor is 65 or over, 37.5 per cent if they are under age 65.

What if there are children 18 or under?

If the family has children 18 or under, there is a monthly portion per child, currently $250.27 a month per child. Children age 18 to 24 can also get this support if they are enrolled in post-secondary school, though they’ll have to prove their enrolment to the government each year.

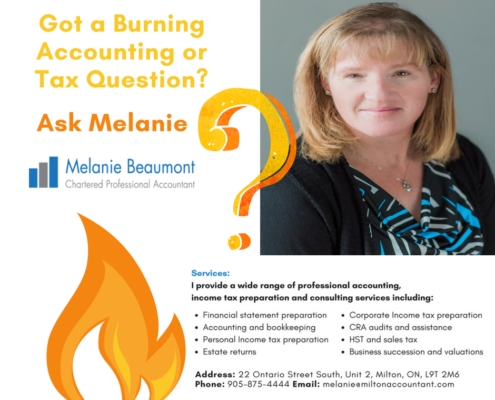

I provide a wide range of professional accounting, income tax preparation and consulting services including:

I provide a wide range of professional accounting, income tax preparation and consulting services including:

• Financial statement preparation

• Accounting and bookkeeping

• Personal Income tax preparation

• Estate returns

• Corporate Income tax preparation

• CRA audits and assistance

• HST and sales tax

• Business succession and valuations

• Business Start-ups

Let’s get started in three easy steps:

- Learn more about me ⇨ Send me a LinkedIn connection invite

- Send me an Email ✉ Send me a message at melanie@miltonaccountant.com

- Call ✆ Give me a call locally at 905-875-4444

Get more advice from Melanie on her blog and connect with her on Facebook and Twitter as well!

Leave a Reply

Want to join the discussion?Feel free to contribute!