#AskMelanie: How can I claim my home office for a tax deduction as an employee?

The COVID pandemic has brought about many changes for individuals in 2020, one being the requirement to work from home as an employee. You may be eligible to claim a tax deduction for your home office expenses (office space, supplies, internet, cell phone, etc.) which were incurred but NOT reimbursed by your employer if you were required to work from home.

As an employee you are eligible to deduct home office expenses if you meet the following conditions:

- You worked more than 50% of the time from home for at least 4 consecutive weeks in 2020 due to COVID-19

- The expenses were directly related to your work

Eligible work from home expenses include:

1. Rent paid

2. Utilities paid

3. Internet paid

4. Supplies (administrative items normally provided by employer) purchased

5. Employment use of a Cell phone paid in 2020

NOTE that you cannot claim items such as mortgage interest, insurance, property taxes, furniture or computers as part of a home office claim.

You might also like: What are some financial lessons of covid-19

There are two ways of calculating the claim, the Flat Rate method (for 2020) or The Detailed method:

- The Flat rate method was introduced for 2020 and if this method is used, you are not required to obtain a T2200 – Declaration of Conditions of Employment. You are also not required to maintain receipts. Under the Flat rate method, you are eligible to claim $2 for each day that you worked at home up to a maximum of $400.

- The detailed method involves calculating the home office claim based on actual receipts and the square footage of your office. NOTE that under this method, you must obtain form T2200 – Declaration of Conditions of Employment from your employer and you must retain all receipts.

The above is a general description of the tax deduction available which may or may not benefit you. I encourage you to discuss your situation with me to determine the availability of this claim and the maximum benefit available to you.

My office is open and ready to serve you.

Monday, Tuesday, Thursday and Friday 9-5. (Saturdays in April)

Phone: 905-875-4444 Email: melanie@miltonaccountant.com

I am accepting personal and corporate tax information in one of four ways:

- In-office – TO ENCOURAGE INDIVIDUALS TO FOLLOW THE STAY AT HOME ORDERS, MY OFFICE IS CLOSED TO THE PUBLIC UNTIL THE PROVINCIAL LOCKDOWN IS LIFTED. I AM IN THE OFFICE WORKING HOWEVER AND AM ONLY A PHONE CALL OR EMAIL AWAY. UNTIL SUCH TIME AS TO LOCKDOWN IS LIFTED, I CAN MEET WITH YOU VIRTUALLY AND INFORMATION CAN BE PICKED UP OR DROPPED OFF USING THE CURBSIDE METHOD.

- Via email – you can scan your documents and then send them to me in an email (preferably send everything in one email).

- Via a portal – I have a secure portal that I can invite you to. We can then share documents between us. This requires that you send me an email requesting the portal. I will then send you an invite to which you then accept and set up with your own password. We can then upload documents and receive notices whenever something changes.

- Mailbox drop-off – there is a mailbox at the back of the building to submit your documents in. It is a locked box that I check a few times a day.

When the tax return(s) are completed, I will be in touch with respect to delivery and pick up options.

Take care and stay safe. If we all work together, this will be over faster!

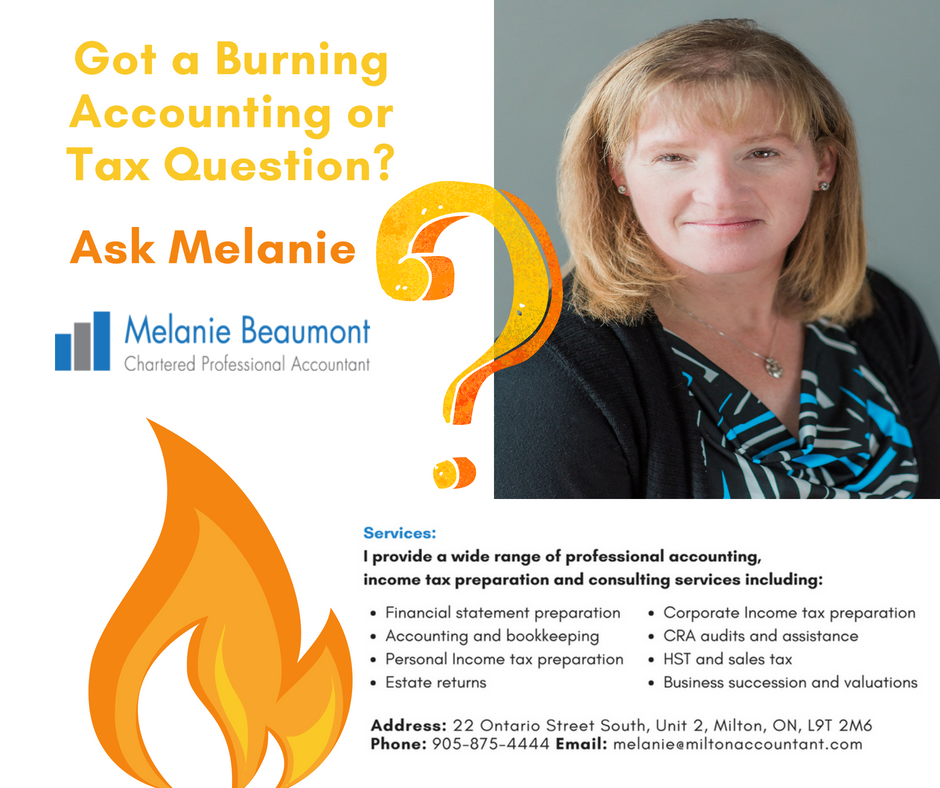

I provide a wide range of professional accounting, income tax preparation and consulting services including:

I provide a wide range of professional accounting, income tax preparation and consulting services including:

• Financial statement preparation

• Accounting and bookkeeping

• Personal Income tax preparation

• Estate returns

• Corporate Income tax preparation

• CRA audits and assistance

• HST and sales tax

• Business succession and valuations

• Business Start-ups

Let’s get started in three easy steps:

- Learn more about me ⇨ Send me a LinkedIn connection invite

- Send me an e-mail ✉ : Send me a messge at melanie@miltonaccountant.com

- Call ✆: Give me a call locally at 905-875-4444

Get more advice from Melanie on her blog and connect with her on Facebook and Twitter as well.