#AskMelanie: What are some financial lessons of COVID-19?

Now is a perfect time to reflect on our financial and business decisions with regard to our spending, business and investment choices. I came across this Globe and Mail article entitled: Six financial lessons of COVID-19: Lifestyle creep, emergency funds and risk tolerance that speaks to some important lessons we can learn out of the impacts from COVID-19.

#AskMelanie: What are some financial lessons from COVID-19? (content courtesy of The Globe and Mail)

We are still early in the fight with COVID-19, but the rapid economic changes caused by the virus have already taught us a few critical financial and business lessons.

RISK IN OUR INVESTMENT PORTFOLIOS

The massive stock market volatility of the last couple of months has shown many people that their risk tolerance is far lower than the arbitrary number they filled out on their investment-policy statement. Now that you have been on the roller-coaster ride, you can quantify your risk aversion. Spend some time thinking about whether your equity or other risk-investment allocation suits your investment objectives and if the potential volatility of these holdings is appropriate for your risk tolerance.

KEEPING EMERGENCY CASH

Standard investment advice has always been to keep a few months of cash to cover living expenses such as mortgage payments and groceries in the case of an emergency. Many people did not heed that advice and are now struggling to make their monthly payments. Now I expect people will make building a reserve of emergency cash funds that can last much longer periods a priority.

WATCH THE LIFESTYLE CREEP

It’s easy to get caught up in “lifestyle creep,” where people expand their lifestyle and spending alongside their increasing salary or income. Lifestyle creep is rearing its sinister head during this crisis. So while your salary, dividends, draws, etc., stop or are cut back, many expenses are fixed and seemingly laugh at you from the credit-card statement. Things such as monthly payments for fancy cars, mortgage payments for our larger-than-necessary homes and lines of credit for inflated personal expenditures are stark reminders of our excessiveness.

While our excessive fixed costs torment us, some of our discretionary expenses have ground to a halt while we are isolating at home – restaurants, clothing purchases, vacations and toll-highway driving to name just a few. You quickly realize how much money you can save on these expenses when you have no bills related to them for a month. This is a sobering experience, and I would expect many people will scale back on some of these non-essential expenses from now on.

BUDGETING

Most people would rather have a root canal than prepare a budget. However, with your income reduced, evaporated or uncertain, a budget will help you understand what funds you need to pay for the fixed costs discussed above. Does your current reduced income, government benefits and savings cover you for the next few months, six months or year? If you have lost your job or now receive a reduced paycheque, how long will you need to defer mortgage or other payments? While long-term planning is uncertain in this environment, you can reduce your fixed costs over time by reviewing the savings available and restricting discretionary spending.

It has never been easier to gather the data for a budget. Pick a 30-day period from when you started self-isolating and summarize all payments on your credit cards and all automatic debits and cheques written on your bank account. This will be the foundation of your budget. You can then layer on one-time expenses not covered in the 30-day period and discretionary expenses. There are several online budgeting tools to assist you. I suggest this process is vital to your financial health and everyone should do it.

BUSINESS CONCENTRATION RISK

COVID-19 has hit small business owners very hard. Not only has their short-term income been devastated, but many of the retirement dreams have been delayed or derailed. The crisis has crystallized the risk of having their retirement funding concentrated on one major asset: their business.

Many small-business owners will now have to rebuild their enterprises over the next few years. Some will likely never receive the payday their retirement was premised upon.

In these tough times, I am still working at the office to prepare your income tax returns so that you can get your money back!

However, the office is closed to visitors.

I am accepting information for tax returns in one of three ways:

- Mailbox drop-off – there is a mailbox at the back of the building to submit your documents in. It is a locked box that I check a few times a day;

- Via email – you can scan your documents and then send them to me in an email (preferably send everything in one email);

- Via a portal – I have a secure portal that I can invite you to. We can then share documents between us. This requires that you send me an email requesting the portal. I will then send you an invite to which you then accept and set up with your own password. We can then upload documents and receive notices whenever something changes.

When the tax return(s) are completed, I will be in touch with respect to delivery and pick up options.

Take care and stay safe. If we all work together, this will be over faster!

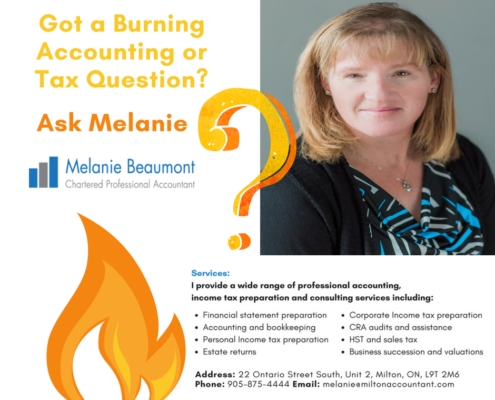

I provide a wide range of professional accounting, income tax preparation and consulting services including:

I provide a wide range of professional accounting, income tax preparation and consulting services including:

• Financial statement preparation

• Accounting and bookkeeping

• Personal Income tax preparation

• Estate returns

• Corporate Income tax preparation

• CRA audits and assistance

• HST and sales tax

• Business succession and valuations

• Business Start-ups

Let’s get started in three easy steps:

- Learn more about me ⇨ Send me a LinkedIn connection invite

- Send me an e-mail ✉ : Send me a message at melanie@miltonaccountant.com

- Call ✆: Give me a call locally at 905-875-4444

Get more advice from Melanie on her blog and connect with her on Facebook and Twitter as well!