#AskMelanie: How can I maximize my 2019 RRSP Contribution? Debunking myths.

February… love is in the air and taxes to potentially pay around the corner. How can you save for your retirement and maximize your tax situation? Melanie’s favourite column “The Bean Counter” dives into the myths around your RRSP contribution. We would love to hear if some of these myths have changed your knowledge around your RRSP contributions for the 2019 tax year.

Melanie’s Tip:

Claiming your RRSP contribution

The earlier you contribute to your RRSP the better as it allows for future compounding. However, claiming the contribution as a tax deduction may be more beneficial in the future year rather than in the current year. As part of preparing your personal tax return, I will evaluate the most beneficial timing for claiming the RRSP deduction in order to maximize your return and minimize the overall amount of income tax you pay.

#AskMelanie:

#AskMelanie:

How can I maximize my 2019 RRSP Contribution? Debunking myths.

It’s that time of year again. We have just a few weeks left until the Registered Retirement Savings Plan (RRSP) deadline, and despite its almost 60 years in existence, there are still plenty of myths and misconceptions surrounding this popular retirement savings plan.

Today, Sarah Rahme, CFP, a wealth advisor with BDO Canada LLP, gets us ready for the 2020 RRSP (MARCH 2, 2020) deadline by demystifying 19 common RRSP myths.

___________

Myth #1: RRSPs are for everyone

The reality is that every Canadian needs to evaluate their own fit for an RRSP. We generally say that Canadians earning a lower income (under $50,000 yearly) should use a Tax Free Savings Account (TFSA) instead. Moderate earners have to weigh the pros and cons before deciding which option will work better for them in the long run. This typically entails weighing the tax savings you would gain today versus the tax cost when you withdraw your RRSP or Registered Retirement Income Fund (RRIF) in the future and how quickly you may need to access the funds in your TFSA.

Myth #2: RRSPs aren’t worth it, since you need to pay tax on withdrawals

Myth #3: RRSPs have one use — retirement

- purchase your first property through the Home Buyer’s Plan (HBP) (up to $25,000 to purchase your first home)

- finance your or your spouse’s training or education with the Lifelong Learning Plan (LLP) ($10,000 per year up to $20,000 in total to finance your education at a qualifying institution).

Myth #4: I should pay off my mortgage and other debt first

Myth #5: I cannot make a withdrawal from my RRSP until I retire

Myth #6: It doesn’t matter when I make my spousal RRSP contribution

Myth #7: I’ll have more money to contribute when I’m older

Myth #8: If I die, the proceeds of my RRSP are subject to taxation

- If the beneficiary of the deceased is a surviving spouse or common-law partner, the funds will roll over tax-free into their RRSP or RRIF.

- If you have a child or grandchild who was dependent on you due to physical or mental infirmity, the funds will roll over tax-free into their RRSP or RRIF.

Myth #9: I don’t have enough money to start investing

Myth #10: I have to take my deduction in the year I contribute

Myth #11: I can only convert my RRSP to a RRIF when I turn 71

Myth #12: Converting my RRSP to a RRIF is my only option when I turn 71

- take out the account value as a lump sum cash payment. In this case, you’d need to pay tax on the whole payment.

- buy a life annuity that would pay income at regular intervals for the rest of your life.

Myth #13: A Spousal RRSP doubles my contributing room

Myth #14: I have to use cash to make my RRSP contribution

Myth #15: I should borrow money to contribute

Myth #16: I should contribute a lump sum just before the Feb. 28 deadline

Myth #17: I have to wait until I turn 18 to open an RRSP

Myth #18: I can hold any types of investments in my RRSP

READ MORE

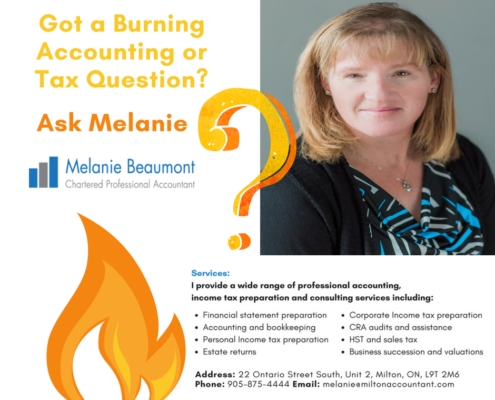

I provide a wide range of professional accounting, income tax preparation and consulting services including:

I provide a wide range of professional accounting, income tax preparation and consulting services including:

• Financial statement preparation

• Accounting and bookkeeping

• Personal Income tax preparation

• Estate returns

• Corporate Income tax preparation

• CRA audits and assistance

• HST and sales tax

• Business succession and valuations

• Business Start-ups

Let’s get started in three easy steps:

- Learn more about me ⇨ Send me a LinkedIn connection invite

- Send me an Email ✉ Send me a message at melanie@miltonaccountant.com

- Call ✆ Give me a call locally at 905-875-4444

Get more advice from Melanie on her blog and connect with her on Facebook and Twitter as well!